Individual Retirement Accounts (IRAs) are a popular vehicle for retirement savings, traditionally focused on investments in stocks, bonds, and mutual funds. However, an emerging trend involves investing in physical gold and silver within IRAs. In this article, we will delve into the mechanics of precious metals IRAs, specifically highlighting the advantages and opportunities they present. We will explore the inclusion of physical gold, including gold bars and ingots, within the gold bullion market, as well as the involvement of reputable bullion dealers like PGS. Additionally, we will address the importance of secure bullion storage within these IRAs, ensuring the safekeeping of valuable assets.

What we cover in this article:

Why Specifically Invest in Gold Coins and Gold Bullion?

How to Invest in Precious Metals with Your IRA Account

IRA Rollover

- Physical gold

- Gold bars

- Gold ingots

- Gold bullion market

- Bullion dealers

- Bullion storage

- Bullion prices

- Gold bullion investment

Individual Retirement Accounts (IRAs) are a popular vehicle for retirement savings, traditionally focused on investments in stocks, bonds, and mutual funds. However, an emerging trend involves investing in physical gold and silver within IRAs. In this article, we will delve into the mechanics of precious metals IRAs, specifically highlighting the advantages and opportunities they present. We will explore the inclusion of physical gold, including gold bars and ingots, within the gold bullion market, as well as the involvement of reputable bullion dealers like PGS. Additionally, we will address the importance of secure bullion storage within these IRAs, ensuring the safekeeping of valuable assets.

Gold IRAs:

A gold IRA is a type of self-directed IRA that invests in gold coins, gold bullion, and other precious metals. They offer many of the same tax advantages as traditional IRAs, including tax-deferred growth and tax-free withdrawals in retirement. Gold IRAs can be a smart way to diversify your retirement savings and protect against inflation and market volatility.

Why Specifically Invest in Gold Coins and Gold Bullion?

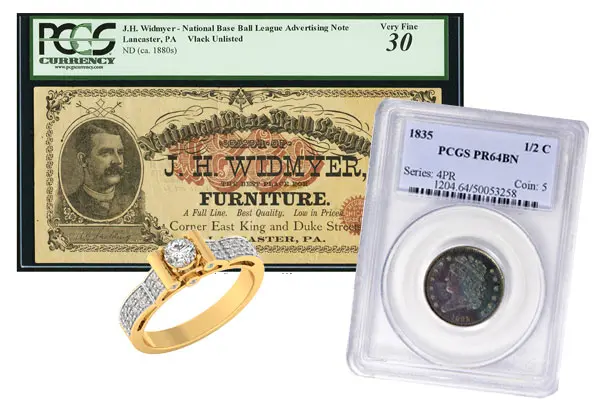

Investing in physical gold, such as gold coins and gold bars, also known as bullion, offers a compelling opportunity for investors. Coins and bullion represent tangible assets that hold inherent value due to their precious metal content. As a form of gold bullion investment, they provide several benefits. First, coins and bullion serve as a reliable store of wealth, preserving value over time. Additionally, they offer diversification and act as a hedge against inflation and market volatility. When investing in coins and bullion, factors to consider include authenticity, purity, and liquidity. It’s crucial to work with reputable bullion dealers like PGS Gold & Coin, who provide trusted and verified products. By carefully evaluating these factors, investors can tap into the potential of coins and bullion to enhance their investment portfolios and safeguard their wealth.

Investing in gold coins and gold bullion can be a great idea for several reasons. Let’s explore the advantages of these investments:

- Store of Value: Gold has been recognized as a store of value for centuries. Its enduring appeal lies in its scarcity and universal acceptance. Gold coins and gold bullion hold intrinsic value, making them a reliable hedge against inflation and economic uncertainties.

- Portfolio Diversification: Gold serves as an effective diversification tool. It has a low correlation with other asset classes like stocks and bonds, which means it can act as a counterbalance to market volatility. By adding gold coins and bullion to your investment portfolio, you can reduce overall risk and enhance long-term stability.

- Tangible Asset: Unlike stocks or bonds that represent ownership or debt, gold coins and bullion are tangible assets that you physically possess. This aspect can provide a sense of security and control, knowing that you have a physical store of wealth that is not dependent on the performance of financial institutions or intermediaries.

- Potential for Appreciation: Gold has demonstrated the potential for long-term appreciation over time. While its value can fluctuate in the short term, gold has historically maintained its purchasing power and has often served as a safe haven during times of economic turmoil. Investing in gold coins and bullion allows you to participate in this potential appreciation.

- Liquidity: Gold coins and bullion are highly liquid assets. They can be easily bought or sold in various markets around the world. This liquidity ensures that you can convert your gold investments into cash relatively quickly if needed, providing you with financial flexibility.

- Portability and Divisibility: Gold coins and bullion offer flexibility in terms of storage and division. Coins, in particular, are highly portable and can be easily transported and stored securely. Additionally, gold bullion can be divided into smaller units, allowing for gradual liquidation if required.

- Historical Significance and Collectability: Gold coins, especially those with historical significance or unique designs, often have additional value beyond their intrinsic gold content. Collectors and enthusiasts are willing to pay premiums for rare or limited-edition coins, providing an opportunity for potential numismatic appreciation.

It’s important to note that like any investment, gold coins and bullion come with their own risks and considerations. Prices can be influenced by various factors, including market conditions, geopolitical events, and investor sentiment. Therefore, it’s advisable to conduct thorough research, consult with financial professionals, and diversify your investment portfolio to mitigate risk.

Overall, investing in gold coins and bullion can be an effective way to preserve wealth, diversify your portfolio, and potentially benefit from the long-term appreciation of this precious metal.

How to Invest in Precious Metals with Your IRA Account

Investing in precious metals, such as gold, silver, platinum, or palladium, through a self-directed IRA involves the following steps:

Select a Precious Metals Dealer Like PGS Gold & Coin: We are a reputable precious metals dealer who specializes in providing IRA-approved precious metals. You must ensure that your dealer is knowledgeable about the IRS regulations regarding the types of metals allowed within an IRA. PGS Gold & Coin has served the Chicagoland area for over 40 years & we are certified precious metals experts. To get in touch use our quick & easy contact form on our Precious Metals IRA Page to request a meeting, or call 888-416-2701 to speak to an expert today.

Purchase Precious Metals: Instruct your self-directed IRA custodian to purchase the desired precious metals from a reputable dealer like PGS Gold & Coin. The custodian will handle the transaction on behalf of the IRA.

Secure Storage: Precious metals purchased through a self-directed IRA must be held in a qualified storage facility approved by the IRS. The storage facility should meet the required standards and ensure the safekeeping of the metals. PGS Gold & Coin has partnered with top agencies in the field to ensure your precious metals savings is secure. Learn more *LINK*

Monitor and Manage: As with any investment, it’s important to monitor the performance of your precious metals holdings within the self-directed IRA. Stay informed about market trends and consult with financial professionals if needed.

It’s crucial to note that the IRS imposes certain restrictions and regulations on investing in precious metals within an IRA. For example, there are specific purity requirements and restrictions on the types of metals allowed. It’s advisable to consult with a tax professional or financial advisor who specializes in self-directed IRAs and precious metals investments to ensure compliance with IRS rules and regulations. Visit our Precious Metals IRA Page to fill out the quick & confidential contact form or call 866-369-7528 from a specialist about your retirement plans today!

Benefits of a Self-Directed IRA:

- Diversification: One of the key benefits of a self-directed IRA is the ability to diversify investments beyond traditional options. This can help reduce risk by spreading investments across different asset classes, potentially increasing the potential for long-term returns.

- Greater Control: Unlike traditional IRAs, which often limit investment choices to a predefined set of options, a self-directed IRA allows individuals to make their own investment decisions. This increased control enables account holders to invest in assets they have knowledge or expertise in, potentially leading to higher returns.

- Alternative Investments: With a self-directed IRA, investors have the opportunity to invest in alternative assets that may not be available in traditional retirement accounts. This can include real estate, private businesses, precious metals, cryptocurrency, and more. It provides individuals with the flexibility to explore investment opportunities outside of the stock market.

- Tax Advantages: Like other IRAs, self-directed IRAs offer potential tax benefits. Depending on the type of self-directed IRA chosen (Traditional or Roth), contributions may be tax-deductible or grow tax-free, respectively. Additionally, any gains made within the account are typically tax-deferred until withdrawals are made during retirement, potentially allowing for tax savings over time.

Retirement Savings:

Investing in precious metals through an IRA can be a smart way to diversify your retirement savings. Precious metals can provide a hedge against inflation and market volatility, and they may appreciate in value over time. While there are risks associated with any investment, including precious metals, they can be a valuable addition to your retirement portfolio.

How to Invest in Precious Metals with a Self-Directed IRA

Investing in precious metals, such as gold, silver, platinum, or palladium, through a self-directed IRA involves the following steps:

- Establish a Self-Directed IRA: Begin by setting up a self-directed IRA with a custodian or administrator who allows precious metals investments. Ensure that the chosen custodian has experience and expertise in facilitating such investments.

- Fund the Account: Transfer funds from an existing IRA or make new contributions to the self-directed IRA to establish the investment capital.

- Select a Precious Metals Dealer: Identify a reputable precious metals dealer who specializes in providing IRA-approved precious metals. Ensure that the dealer is knowledgeable about the IRS regulations regarding the types of metals allowed within an IRA.

- Purchase Precious Metals: Instruct your self-directed IRA custodian to purchase the desired precious metals from the approved dealer. The custodian will handle the transaction on behalf of the IRA.

- Secure Storage: Precious metals purchased through a self-directed IRA must be held in a qualified storage facility approved by the IRS. The storage facility should meet the required standards and ensure the safekeeping of the metals. PGS Gold & Coin has partnered with top agencies in the field to ensure your precious metals savings is secure. Learn more *LINK*

- Monitor and Manage: As with any investment, it’s important to monitor the performance of your precious metals holdings within the self-directed IRA. Stay informed about market trends and consult with financial professionals if needed.

It’s crucial to note that the IRS imposes certain restrictions and regulations on Investing in precious metals through an IRA can provide many benefits, including tax advantages, diversification, and protection against inflation and market volatility. With a variety of options available, including gold coins, gold bullion, mutual funds, and ETFs, there is something for every investor. Whether you choose a traditional or self-directed IRA, investing in precious metals can be a valuable addition to your retirement portfolio.

Visit A PGS Gold & Coin Location Near You!

Palatine, IL

830 W. Northwest Highway Suite 7

Palatine, IL 60067

Mon-Fri 10am-6pm

Sat 10am-3pm

Sun Closed

Wheaton, IL

600 South County Farm Road

Wheaton, IL 60187

Mon-Fri 10am-6pm

Sat 10am-3pm

Sun Closed

Schaumburg, IL

900 S Roselle Rd

Schaumburg, IL 60193

Mon-Fri 10am-6pm

Sat 10am-3pm

Sun Closed

Villa Park, IL

231 W North Ave

Villa Park, IL 60181

Mon-Fri 10am-6pm

Sat 10am-3pm

Sun Closed