These are our most frequently asked silver investing questions:

Will silver be worth more in 10 years?

It’s important to note that predicting future commodity prices, including silver, is highly speculative and subject to a wide range of factors. Here are some of the top silver inquiries we see as bullion dealers:

Will silver be worth more in 10 years? Predicting specific price movements is challenging, but silver’s value can be influenced by factors like economic conditions, industrial demand, and investor sentiment.

What will silver be worth in 2050? Predicting prices for such a distant future is highly uncertain and speculative. Many unpredictable factors will influence the value of silver over the next several decades.

Silver price predictions for the next 5 years: Forecasting short-term prices involves analyzing current market conditions, geopolitical events, and economic trends. Consult financial experts or refer to reputable financial forecasts for the most up-to-date predictions.

Silver price predictions for 2040: Long-term predictions involve even more uncertainty. Economic, technological, and geopolitical developments over the next decades will play a significant role in shaping silver prices.

Will silver ever be worthless? It’s unlikely that silver, a precious metal with industrial applications and historical value, will become entirely worthless. However, its value can fluctuate based on market dynamics.

Will silver hit $1000 an ounce? Predicting specific price targets is challenging. While silver hitting $1000 an ounce would be a significant increase, it’s difficult to predict such levels due to the multitude of factors influencing commodity prices.

What will 1 oz of silver be worth in 10 years? Specific predictions for a single ounce of silver in the future are uncertain. Factors like inflation, economic conditions, and market dynamics will play a role.

Silver price prediction in 20 years: Long-term predictions involve a high degree of uncertainty. Consider consulting financial experts or referring to reputable financial forecasts for insights into potential trends.

Always approach predictions with caution and consider the inherent risks associated with investing in commodities. Diversification and staying informed are key principles in managing investment risk.

Is silver a good investment during inflation?

Investing in silver during inflation is a strategy that some investors consider. Precious metals like silver are often viewed as a hedge against inflation because their value tends to rise as the purchasing power of fiat currencies decreases. During periods of inflation, where the general price level of goods and services is increasing, investors may turn to silver as a store of value.

Whether it’s smart to invest in silver right now depends on various factors, including your financial goals, risk tolerance, and the current market conditions. It’s essential to conduct thorough research and, if needed, consult with financial professionals to make informed investment decisions.

What is the historic ratio between gold and silver?

The historic ratio between gold and silver has fluctuated over time. Historically, the Gold-Silver Ratio (GSR) has varied between 10 and 15, with records showing an even lower ratio of 2.5 in ancient Egypt. Notably, dating back to ancient Rome, approximately eight ounces of silver have been mined for every ounce of gold annually. For those interested in precious metals, consider buying bullion with PGS Gold & Coin for a secure and reliable investment option.

As for historical performance, comparing gold and silver through historical charts can provide insights into their relative value over time. Historical price charts for 10, 20, and 50 years can show trends, patterns, and potential correlations with economic events. Keep in mind that past performance does not guarantee future results, and the precious metals market can be influenced by a wide range of factors.

If you’re considering investing in precious metals like gold or silver, it’s advisable to diversify your portfolio and not rely solely on one asset class. Additionally, staying informed about economic indicators, geopolitical events, and market trends is crucial for making well-informed investment decisions. Consider consulting with a financial advisor to tailor your investment strategy to your specific financial situation and goals.

Is it smart to invest in silver right now?

Here are some general considerations for anyone thinking about investing in silver:

Market Research: Before making any investment, it’s crucial to conduct thorough market research. Understand the current trends, historical performance, and potential factors that could influence the price of silver.

Diversification: Diversifying your investment portfolio is a fundamental principle of risk management. Don’t put all your funds into a single asset class, including precious metals. A diversified portfolio can help mitigate risk.

Financial Goals: Consider your financial goals and investment horizon. Are you looking for short-term gains, or are you investing with a long-term perspective? Your investment strategy should align with your financial objectives.

Risk Tolerance: Precious metals, including silver, can be volatile. Assess your risk tolerance and only invest what you can afford to lose. If you’re risk-averse, you may want to explore less volatile investment options.

Consult Professionals: If you’re uncertain about investing in silver or any other asset, consider seeking advice from financial professionals. A financial advisor can provide personalized guidance based on your financial situation and goals.

Global Economic Conditions: Consider the broader economic conditions, geopolitical events, and other factors that may impact the value of silver. Changes in interest rates, inflation, and currency movements can all influence precious metal prices.

Remember that all investments carry some level of risk, and there are no guarantees of profit. It’s essential to make informed decisions based on your own research and financial circumstances. If you’re unsure, consulting with a financial advisor is a prudent step before making any investment decisions.

Will silver be worth more in 10 years?

Predicting the future value of commodities like silver is inherently uncertain and influenced by a multitude of factors. Silver, like any other investment, is subject to market conditions, economic trends, geopolitical events, and various other variables.

Several factors could potentially impact the future value of silver:

Supply and Demand: Changes in industrial demand, technological advancements, and fluctuations in mining production can influence the supply and demand dynamics of silver.

Economic Conditions: Economic indicators, inflation rates, and overall economic health can affect the value of silver. During periods of economic uncertainty or inflation, precious metals like silver may be sought after as a store of value.

Geopolitical Events: Political instability, trade tensions, and other geopolitical factors can impact global markets and influence the value of precious metals.

Currency Movements: The value of silver is often inversely correlated with the strength of the U.S. dollar. Changes in currency values can affect the price of silver.

Investor Sentiment: Market sentiment and speculative activities can also play a role in short-term price movements.

Given the complexity of these factors, it’s challenging to accurately predict the future value of silver in 10 years. Investors should approach such predictions with caution and consider diversifying their portfolios to manage risks effectively. Additionally, staying informed about market trends and consulting with financial experts can help make more informed investment decisions.

Is silver a good investment during inflation?

Silver is often considered a potential hedge against inflation, and some investors turn to precious metals like silver during times of rising inflation. Here are a few reasons why silver might be viewed as a good investment during inflation:

Inflation Hedge: Precious metals, including silver, have historically been seen as stores of value. During periods of inflation, the purchasing power of fiat currencies tends to decrease. Investors may turn to silver as a way to protect their wealth and purchasing power.

Industrial Demand: Silver has various industrial applications, including in electronics, solar panels, and medical devices. Increased industrial demand during economic growth can contribute to the metal’s value.

Historical Trends: In the past, silver prices have sometimes shown a positive correlation with inflationary periods. This historical relationship has led some investors to consider silver as a hedge against the eroding effects of inflation on traditional assets.

However, it’s important to note that investing in silver, like any investment, carries risks. Various factors such as changes in industrial demand, currency movements, and market sentiment can impact the performance of silver.

Before making any investment decisions, it’s advisable to thoroughly research and consider your financial goals, risk tolerance, and investment horizon. Consulting with financial professionals can also provide personalized advice based on your individual circumstances. Diversifying your investment portfolio is generally recommended to spread risk across different asset classes.

What is a good ratio of gold to silver?

The ratio of gold to silver has seen significant fluctuations throughout history. While opinions vary, many silver investors advocate for a ratio of 16:1, citing the abundance of silver in the Earth’s crust compared to gold. For those interested in precious metals investing, consider buying bullion and seek expert guidance from the knowledgeable staff at PGS Gold & Coin to make informed decisions.

When considering the future of silver as an investment, it’s important to weigh various factors such as market trends, inflation, and the historic ratio between gold and silver. While the value of silver in 10 years is uncertain, it has historically been considered a good investment during periods of inflation. Understanding the historic ratio between gold and silver can provide valuable insights for diversifying precious metal investments. As for the current moment, many investors view silver as a smart addition to their portfolios. When determining the ratio of gold to silver for investment, it’s wise to seek professional guidance to align with individual financial goals and market conditions.

Palatine, IL

830 W. Northwest Highway Suite 7

Palatine, IL 60067

Mon-Fri 10am-6pm

Sat 10am-3pm

Sun Closed

Wheaton, IL

600 South County Farm Road

Wheaton, IL 60187

Mon-Fri 10am-6pm

Sat 10am-3pm

Sun Closed

Schaumburg, IL

900 S Roselle Rd

Schaumburg, IL 60193

Mon-Fri 10am-6pm

Sat 10am-3pm

Sun Closed

Villa Park, IL

231 W North Ave

Villa Park, IL 60181

Mon-Fri 10am-6pm

Sat 10am-3pm

Sun Closed

Looking to earn some extra cash?

Looking to upgrade your style with something new? Cash in your unwanted gold, silver & platinum jewelry for a fair appraisal at PGS Gold & Coin.

At PGS Gold & Coin, we have built a reputation as the most trusted jewelry buyer in the Chicago area because we routinely offer better appraisals than other jewelry buyers. Bring in your scrap gold, silver, or platinum! Whether it’s old jewelry you don’t wear anymore or mismatched earrings, and our professionals will weigh and evaluate it on the spot. Walk away with cash in hand for your items. Visit our PGS Gold & Coin Stores and get the most value for your gold today!

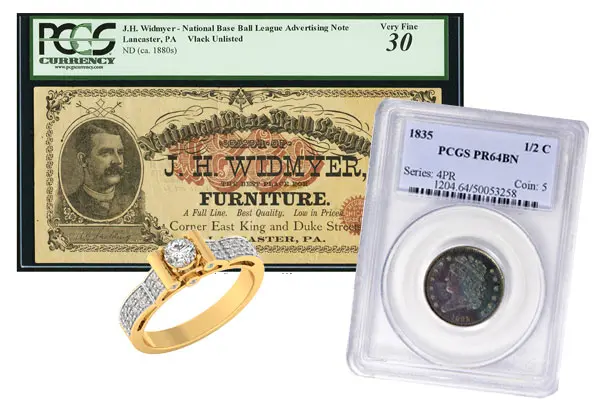

PGS Appraises & Buys:

Coins, Bullion, Platinum, Gold, Sterling Silver, Palladium, US & Foreign. Coins & Currency, Diamonds & Jewelry.