Gold is a precious metal that has captivated people for centuries due to its beauty and enduring value. Throughout history, it has been utilized as currency, jewelry, and a symbol of wealth. In recent times, more investors are turning to gold as a means of diversifying their portfolios and safeguarding their assets. This article will explore ten advantages of investing in physical gold, such as gold bars and gold ingots, within the gold bullion market. We will also delve into the role of bullion dealers, the importance of secure bullion storage, and the factors influencing bullion prices, all of which are essential considerations for gold bullion investment.

1. Hedge against inflation:

Gold has a long-standing reputation as a hedge against inflation. During periods of rising inflation, when the value of traditional currencies tends to erode, gold often retains or even increases its value, preserving purchasing power.

2. Diversification:

Incorporating gold bullion into an investment portfolio provides diversification benefits. With a low correlation to other asset classes like stocks and bonds, gold’s value often moves independently, offering a potential shield against market volatility and reducing overall portfolio risk.

3. Store of value:

Physical gold has stood the test of time as a reliable store of value. Its inherent worth and limited supply contribute to its ability to withstand depreciation over the long term. Unlike fiat currencies, which can lose value due to economic fluctuations or government policies, gold maintains its value and purchasing power.

4. Safe haven asset:

In times of economic uncertainty, geopolitical tensions, or stock market turbulence, gold is sought after as a safe haven asset. It is perceived as a stable and tangible store of wealth, providing investors with a sense of security during periods of financial instability.

5. Currency devaluation protection:

Gold acts as a safeguard against currency devaluation. When a currency experiences a decline in value, the price of gold in that currency often rises. Owning gold helps mitigate the erosion of wealth caused by currency devaluation.

6. Limited supply:

Gold’s scarcity contributes to its allure as an investment. Unlike fiat currencies that can be endlessly printed, the supply of gold is limited. The complexity of gold mining and the rarity of new discoveries ensure a relatively stable supply, thereby enhancing its value.

7. Liquidity:

Gold is highly liquid, meaning it can be easily bought or sold. Investors can access gold through various forms, including physical gold such as coins, bars, or jewelry, as well as paper gold through exchange-traded funds (ETFs), futures, or options. The deep and active global gold market allows for swift entry or exit from positions.

8. Tangible asset:

Gold’s physical nature sets it apart from stocks, bonds, or other financial instruments. The tangibility of gold provides investors with a sense of security, as they own a physical asset with inherent value that cannot be easily manipulated or devalued.

9. Portfolio insurance:

Incorporating gold into a portfolio acts as insurance against negative events or market downturns. During times of economic crisis or stock market crashes, gold has a historical tendency to retain or increase its value, serving as a buffer against losses incurred in other investments.

10. Cultural and historical significance:

Gold holds immense cultural and historical significance worldwide. Its enduring appeal and recognition as a precious metal make it a desirable investment for individuals who appreciate its rich history and cultural importance.

While investing in gold offers numerous advantages, it is crucial to remember that, like any investment, it carries risks. Thorough research, professional advice, and consideration of personal financial goals and risk tolerance are essential before making any investment decisions.

Connect With Us!

Looking to be connected with a local representative?

Fill out the form below and a member of staff will connect you with the right person.

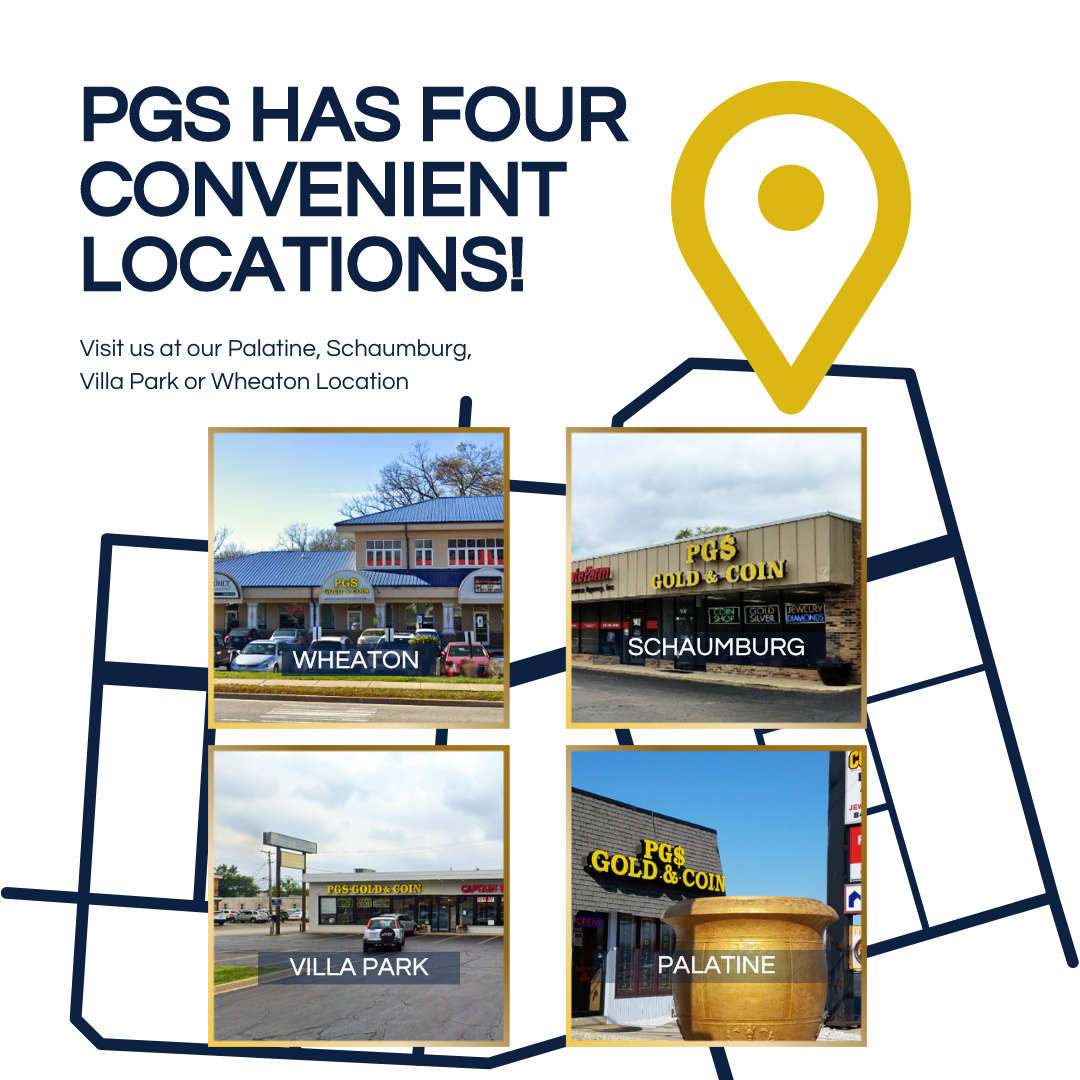

You can invest in Gold or Silver With PGS Gold & Coin

Contact PGS Gold & Coin, your trusted gold bullion dealers for more information at 888-416-2701.

What to know about both:

Gold:

– Gold bullion coins or bars are a popular choice for investment purposes because they are typically easy to buy and sell and are widely recognized around the world.

– The most popular gold bullion coins include the American Gold Eagle, the Canadian Gold Maple Leaf, and the South African Krugerrand.

– Gold coins that are considered rare or historical may also have additional value due to their rarity and collector appeal.

Silver:

– Silver bullion coins or bars are also a popular choice for investment purposes and can be more affordable than gold for those who are on a tighter budget.

– The most popular silver bullion coins include the American Silver Eagle, the Canadian Silver Maple Leaf, and the Austrian Silver Philharmonic.

– Like gold, silver coins that are considered rare or historical may also have additional value due to their rarity and collector appeal.

It is important to note that the value of precious metals can fluctuate. So it is important to carefully consider your investment goals and consult with a financial advisor before making any precious metals investment decisions.

Contact PGS Gold & Coin, your trusted gold bullion dealers for more information at 888-416-2701.

Many different types of items.

- US & Foreign Coins & Currency

- Bullion- Gold, Silver, Platinum & Palladium

- Jewelry- Gold, Silver & Platinum

- Diamonds & Engagement Rings

- Dental Gold

- Sterling Silver Flatware, Tea Sets & Platters

- Fine Wine & Vintage Liquor

- Military & Sports Memorabilia

- Stamp Collections

Do you see an item on the list you’re thinking about selling? We’ve made it quick & easy to get a Free Evaluation of your items! Fill out our quick & easy FREE evaluation for here. You can also fill out our quick & convenient form here for a Free Evaluation.

We are Professional Numismatists, Appraisers and Precious Metal Specialists. We are well versed in collectibles, memorabilia & more!

With over 45 years of experience, we have built a strong reputation as a trusted name in our community.